WHAT HAPPENS TO MY PETS WHEN I DIE?

Whether it’s a horse, dog, cat, rodent, or reptile, many times our pets feel like family and you may want to make sure they’re taken care of like family if they outlive you. There are three primary ways to ensure your pets are taken care of after your lifetime. The first is the most common, where someone who you trust and knows the pet, steps in as the caregiver without any official documentation, the second is naming a person in your will who will get the pet, and the last is a pet trust, which is the most complex and specific.

For most people, the fist option makes the most sense. There is often someone who already shares in the care of the pet or is close to you, who would gladly take over as owner, if something were to happen to you. Although may times this is assumed, it’s good to ask the person to make sure that they would want to step in as a caregiver. We also recommend providing this person with a road map to seamlessly take over, which may include the pet’s health history, favorite foods and toys, daily routine, etc. As with most estate planning, the more information you can provide, the easier it is for those who survive you to take care of your affairs.

The second option for making sure your pets are taken care of is to designated person in your will who ownership will transfer to at the time of your death or permanent incapacitation. This could be especially important if there is reason to believe that someone other than the person you’d like to be the new owner would try to gain possession of the pet. Pets are considered tangible personal property, like a piece of art or a car, and can be left to a specific person in your will.

Until 2005, the law in Hawaii viewed pets simply as property. You could use a will or will substitute to transfer ownership and provide funding, but the new owner could not be forced to spend the money on the pet. In 2005, Hawaii’s legislature joined a growing number of states that enforce so-called pet trusts that benefit one or more specific animals.

A trust may be used in addition to a will to determine when, how and to whom your assets will be distributed. If the trust is created during your life, and if all significant assets are transferred into it, a probate will not be required. The trust "survives" death and may continue well beyond it; the trustee will be in charge of its administration and the management of the assets until the trust terminates and those assets are distributed.

A pet trust names one or more trustees who will have a legal duty to provide the desired level of care when you die or becomes legally incapacitated. It also empowers one or more named persons to enforce the trust in accordance with the creator’s stated wishes (trustee).

The details of establishing a pet trust can be tricky. A statement in a will or will substitute that a named person has agreed or is required to care for the pet would not necessarily create a legally binding pet trust. And the person named in a proper pet trust document could always simply refuse the trusteeship. That’s one reason why it can be important to provide for a backup trustee, or to add a mechanism for selecting a backup trustee.

In conclusion, the three ways to ensure that your pets are taken care of in the event of your incapacity or death are informally appointing a guardian, stating a guardian in your will, and creating a pet trust. As with all “Just Ask John” posts, this does not qualify as legal advice. Please consult with an estate planning a attorney to determine what is best for your situation.

JOHN ROTH

John is the founder of Hawaii Trust & Estate Counsel, a statewide Hawaii estate planning law firm with offices in Waimea, Hilo, Kona, Maui, and Honolulu. He has taught Estate Planning at the Richardson School of Law, and business law courses at the University of Hawaii—Hilo. He has resided in North Hawaii since 2008....MORE

MAKE AN INFORMED DECISION

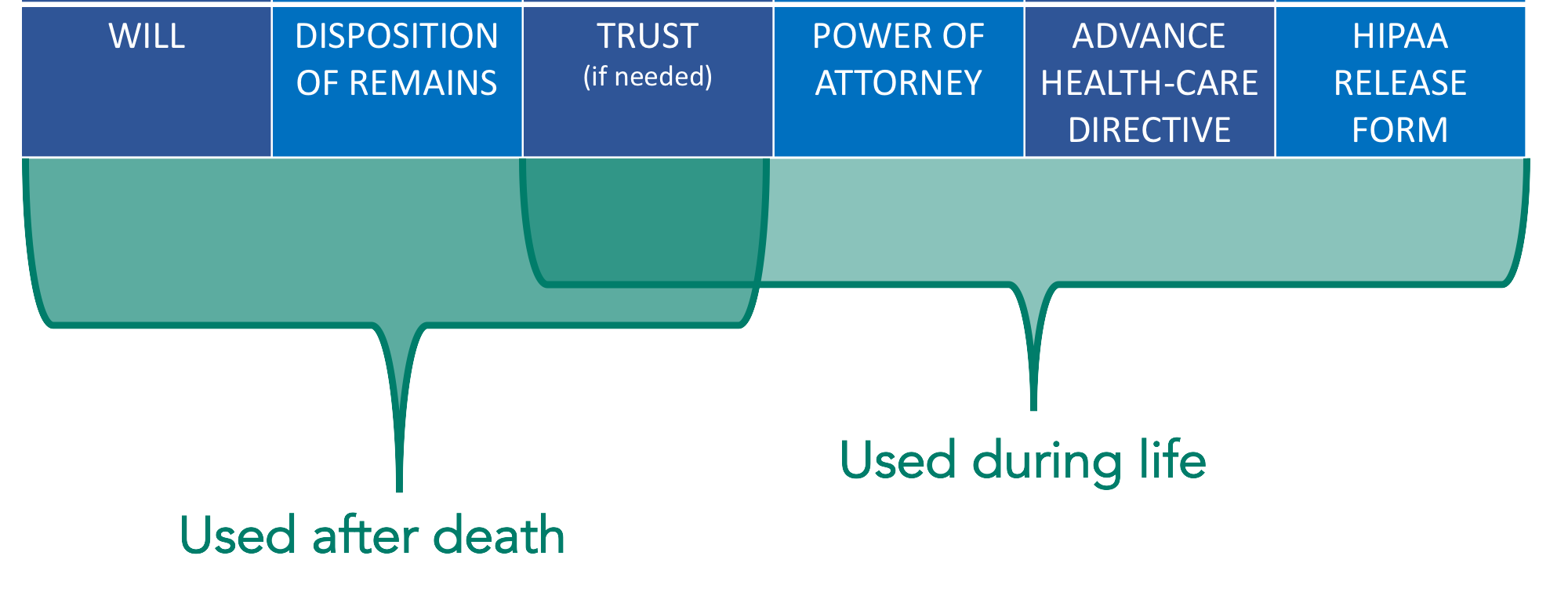

Estate Planning is necessary because, as the old expression goes, "You can't take it with you" and you never know what's going to happen in life. The estate planning documents of an advance health-care directive, power of attorney, and sometimes a trust help someone step into your shoes to make decisions on your behalf, during your lifetime. Then after your lifetime, you may need a will or will substitute, such as a revocable living trust, if they want to control who inherits their property and how and when that inheritance is received, to minimize administration costs, and to avoid unnecessary taxes. A well-planned estate is a gift to your loved ones and provides you peace of mind. It is part of your legacy.

ESTATE PLANNING DOCUMENTS

Everyone has a different story and should have a unique estate plan. In most cases, the first meeting with one of our attorneys is complementary and serves the purpose of understanding your goals and educating you on your options. Depending on the option that is right for you, we will give you a price quote at the first meeting, before moving forward with your plan. Feel free to explore the basic information on our website.

This blog does not contain legal advice. You should not rely on this to determine what is in your own best interest. For legal advice, specific to your situation, you must meet with an attorney. All posts are based on hypothetical scenarios, not the actual circumstances of real clients.

What assets should you put in your trust? Avoiding probate, planning in case of incapacity, and making things as easier for loved ones after your death are all things to consider.