IS MY OUT-OF-STATE TRUST STILL VALID?

This is a questions we get a lot. Many people move to Hawaii from other states for retirement, seeking a more laid-back community, or for a tropical climate. Many new Hawaii residents bring their estate plans with them, when they come, and want to make sure that their plan still works in Hawaii.

All 50 states have their own set of laws that govern estate planning in that state. So, as a general rule of thumb, whenever you move to a new state, you should have your estate plan reviewed by an attorney in the state where you currently reside (no matter where it was originally created). This makes sure that your estate plan is still valid and also takes advantage of all state-specific laws in your new state of residence. Even if you haven't moved to a new state, it's recommended to review your estate plan every 4-5 years.

Sometimes, new Hawaii residents come into our office, we look over their will and or trust, and their will or trust look great because they are congruent with Hawaii law. But, at a minimum, there are two estate planning documents that need updating. These are the advance healthcare directive and the power of attorney. An advance healthcare directive (referred to sometimes as a Living Will and Healthcare Power of Attorney) facilitates the making of health care decisions by your agent if you are unable to make them yourself. A power of attorney (or durable power of attorney) appoints another individual to act as your agent on your behalf, usually to handle financial affairs. This document can be especially important if you become incapacitated. The alternative, a court-appointed guardian, requires legal proceedings that can be slow, expensive, public, and onerous over time. According to Hawaii statue, these two documents must use specific language spelled out in Hawaii law. Also, financial and health institutions are more likely to accept these documents if they were executed within 5 years.

An example of a Hawaii-specific trust legal issue that an estate planning attorney may be able to spot is a special type of property ownership for a married couple called "tenants-by-the-entirety." Such ownership is often used for real property and serves to protect the whole of the property from the creditors of either individual spouse. (It does not, however, protect against a joint creditor such as a mortgage company, where both spouses may be guarantors of a trust.)

In the past, this protection was lost upon any transfer that broke the tenancy, such as a transfer to trust. Under a new Hawaii law, however, married couples may now maintain the creditor protection afforded them as tenants-by-the-entirety even after the property is transferred into trust. If property is already in trust, however, it must be deeded out and then deeded back into trust to benefit from the new law.

Regardless of where you're from or what state you moved to, only a licensed attorney in your state of residence can ensure that estate plan is valid in your new state. If you recently moved and are looking for an estate planning attorney, here are a few tips for what to look for.

JOHN ROTH

John is the founder of Hawaii Trust & Estate Counsel, a statewide Hawaii estate planning law firm with offices in Waimea, Hilo, Kona, Maui, and Honolulu. He has taught Estate Planning at the Richardson School of Law, and business law courses at the University of Hawaii—Hilo. He has resided in North Hawaii since 2008....MORE

MAKE AN INFORMED DECISION

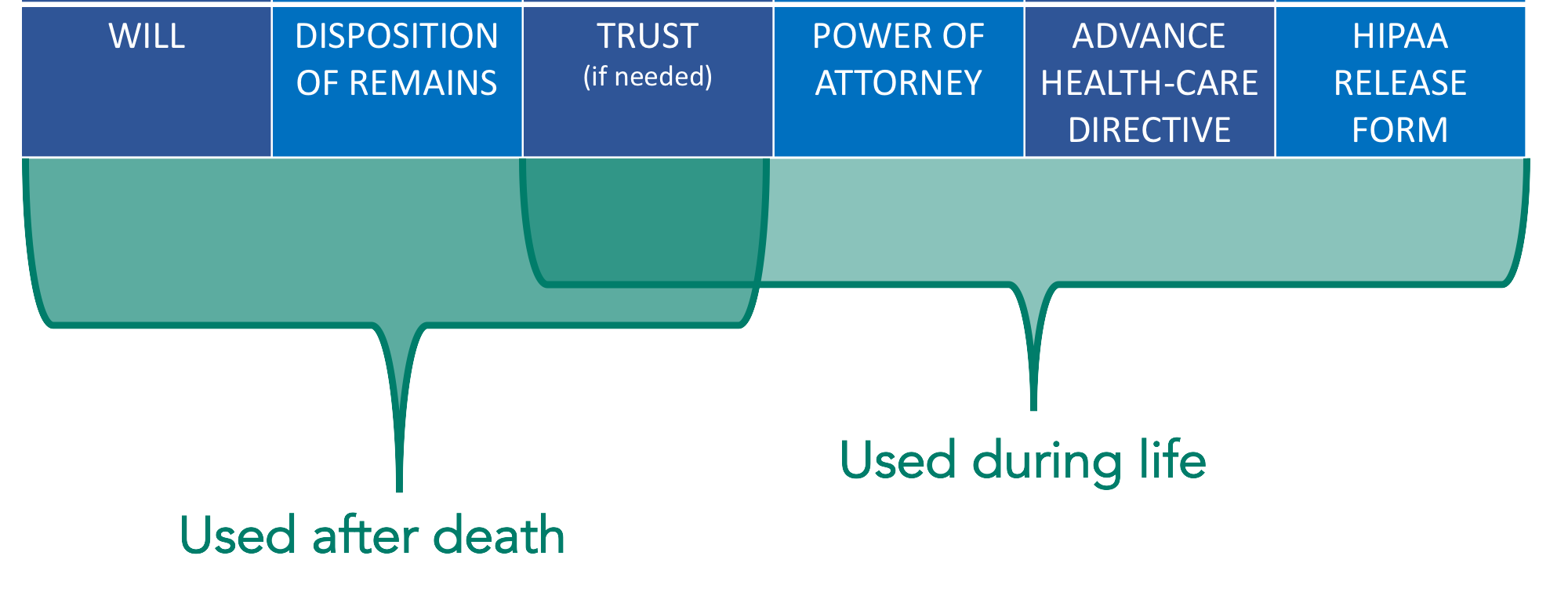

Estate Planning is necessary because, as the old expression goes, "You can't take it with you" and you never know what's going to happen in life. The estate planning documents of an advance health-care directive, power of attorney, and sometimes a trust help someone step into your shoes to make decisions on your behalf, during your lifetime. Then after your lifetime, you may need a will or will substitute, such as a revocable living trust, if they want to control who inherits their property and how and when that inheritance is received, to minimize administration costs, and to avoid unnecessary taxes. A well-planned estate is a gift to your loved ones and provides you peace of mind. It is part of your legacy.

ESTATE PLANNING DOCUMENTS

Everyone has a different story and should have a unique estate plan. In most cases, the first meeting with one of our attorneys is complementary and serves the purpose of understanding your goals and educating you on your options. Depending on the option that is right for you, we will give you a price quote at the first meeting, before moving forward with your plan. Feel free to explore the basic information on our website.

This blog does not contain legal advice. You should not rely on this to determine what is in your own best interest. For legal advice, specific to your situation, you must meet with an attorney. All posts are based on hypothetical scenarios, not the actual circumstances of real clients.

What assets should you put in your trust? Avoiding probate, planning in case of incapacity, and making things as easier for loved ones after your death are all things to consider.