WHAT IF I DIE WITHOUT A WILL?

Will the State take my property? Will my loved ones pay more taxes? These are common questions that come up when discussing what happens if you die without a will, but aren’t necessarily true.

If you were to pass away without saying in a will who you would like to get your assets after you go, you are considered to have died "intestate". Each state has intestate succession statues that try to guess who you would want to get your stuff if you don’t have a will. In Hawaii, Hawaii Revised Statutes Section 560:2-101 to 103 governs intestate succession.

Most times, if someone dies without a will, their estate will go through probate. Probate is a process where a deceased person's estate is distributed to heirs and designated beneficiaries and any debt owed to creditors is paid.

Not all property has to pass through probate or is even controlled by a will or trust (if you had one). For example, if you held a bank account jointly with your spouse, the surviving spouse will automatically own it all as a consequence of the other joint owner’s death. Likewise, a person who is designated as the beneficiary of a pay-on-death account or contract can have that account or benefit from that contract, without having to go through probate. The surviving joint tenant/owner or designated beneficiary simply needs to provide a death certificate to make the transfer official.

INTESTATE SUCCESSION

Despite the legislature’s good intentions, property controlled by intestate rules sometimes passes to someone you would never have selected. For example, property passing to the decedent’s children will be shared by them equally, even if the decedent had made clear (but not in a valid will) that he did not want a particular child to get anything—and even if that child had once demanded and talked the parent into giving that child “his or her inheritance” before the parent died.

Intestacy rules vary from state to state. Consider this hypothetical fact pattern: Mrs. Jones’ first husband died young, leaving Mrs. Jones with two very young children. Eventually Mrs. Jones meets and marries Mr. Smith, and he raises Mrs. Jones’ children as though they are his own. Eventually Mrs. Jones dies, leaving all her property to Mr. Smith, expecting that he will eventually leave everything to Mrs. Jones' children. But if Mr. Smith dies without leaving a will or any will-substitutes, none of his property—not even the property he received from Mrs. Jones—will pass to Mrs. Jones' children. This is because they are his stepchildren, not legally recognized children.

If Mr. Smith in the above hypothetical is not survived by at least one grandparent or a grandparent’s descendant (parent, siblings, sibling's children etc.), his entire estate—including the property received from Mrs. Jones—will pass to the State. Mrs. Jones' children will be given nothing. In some states Mr. Smith’s property would pass to his stepchildren rather than to the State, but not in Hawaii.

There are additional reasons why every adult should have a will, but it's especially important to make sure that your property goes to who you wish after your lifetime.

JOHN ROTH

John is the founder of Hawaii Trust & Estate Counsel, a statewide Hawaii estate planning law firm with offices in Waimea, Hilo, Kona, Maui, and Honolulu. He has taught Estate Planning at the Richardson School of Law, and business law courses at the University of Hawaii—Hilo. He has resided in North Hawaii since 2008....MORE

MAKE AN INFORMED DECISION

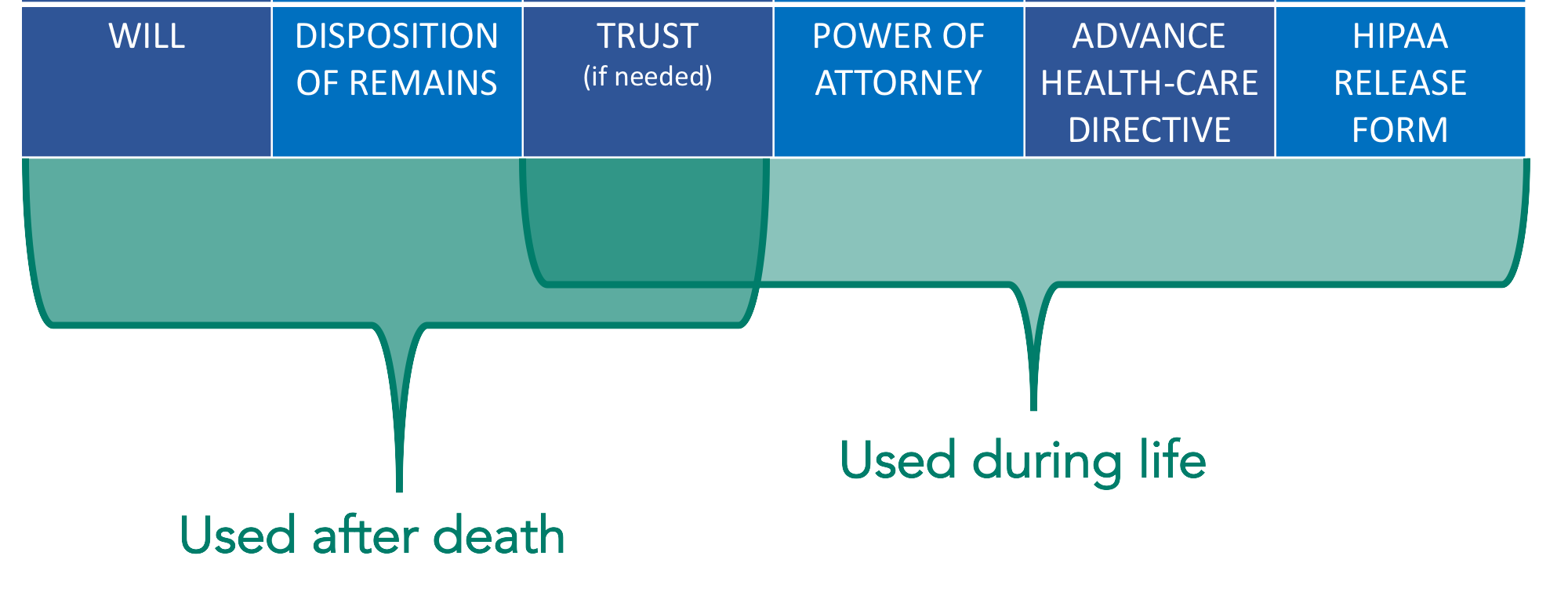

Estate Planning is necessary because, as the old expression goes, "You can't take it with you" and you never know what's going to happen in life. The estate planning documents of an advance health-care directive, power of attorney, and sometimes a trust help someone step into your shoes to make decisions on your behalf, during your lifetime. Then after your lifetime, you may need a will or will substitute, such as a revocable living trust, if they want to control who inherits their property and how and when that inheritance is received, to minimize administration costs, and to avoid unnecessary taxes. A well-planned estate is a gift to your loved ones and provides you peace of mind. It is part of your legacy.

Everyone has a different story and should have a unique estate plan. In most cases, the first meeting with one of our attorneys is complementary and serves the purpose of understanding your goals and educating you on your options. Depending on the option that is right for you, we will give you a price quote at the first meeting, before moving forward with your plan. Feel free to explore the basic information on our website.

This blog does not contain legal advice. You should not rely on this to determine what is in your own best interest. For legal advice, specific to your situation, you must meet with an attorney. All posts are based on hypothetical scenarios, not the actual circumstances of real clients.

What assets should you put in your trust? Avoiding probate, planning in case of incapacity, and making things as easier for loved ones after your death are all things to consider.