Amid social distancing measures and uncertainty about COVID-19, we partnered with Tutu’s House to give a Will vs. Trust webinar. This video contains the highlights of this estate planning webinar by attorney John Roth.

The original webinar was over an hour long, so we did our best to summarize the points participants found most helpful into this 15 minute video below.

WHAT IS ESTATE PLANNING?

Estate planning is the proactive process of setting up a plan in case of your incapacity or death. Estate Planning is necessary because, as the old expression goes, "You can't take it with you" and you never know what's going to happen in life.

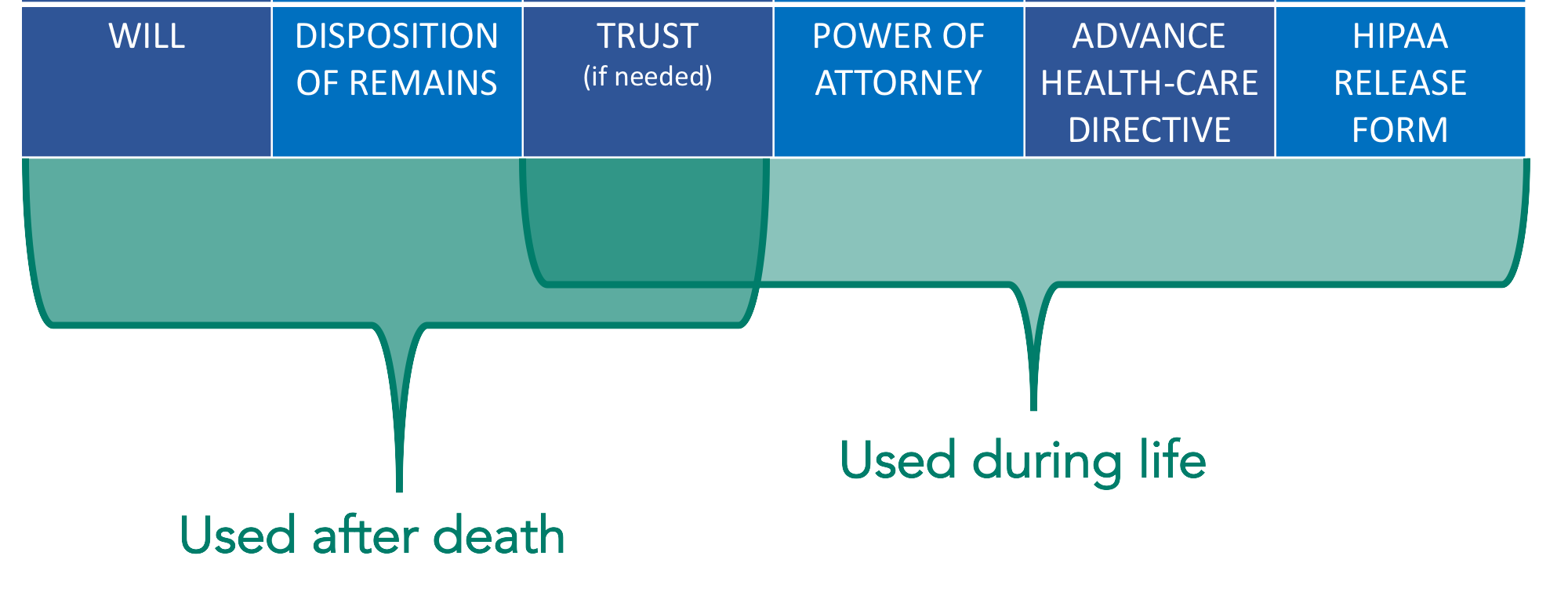

The estate planning documents of an advance health-care directive, power of attorney, and sometimes a trust help someone step into your shoes to make decisions on your behalf, during your lifetime. Then after your lifetime, you may need a will or will substitute, such as a revocable living trust, if they want to control who inherits their property and how and when that inheritance is received, to minimize administration costs, and to avoid unnecessary taxes. A well-planned estate is a gift to your loved ones and provides you peace of mind. It is part of your legacy.

BASIC ESTATE PLANNING DOCUMENTS

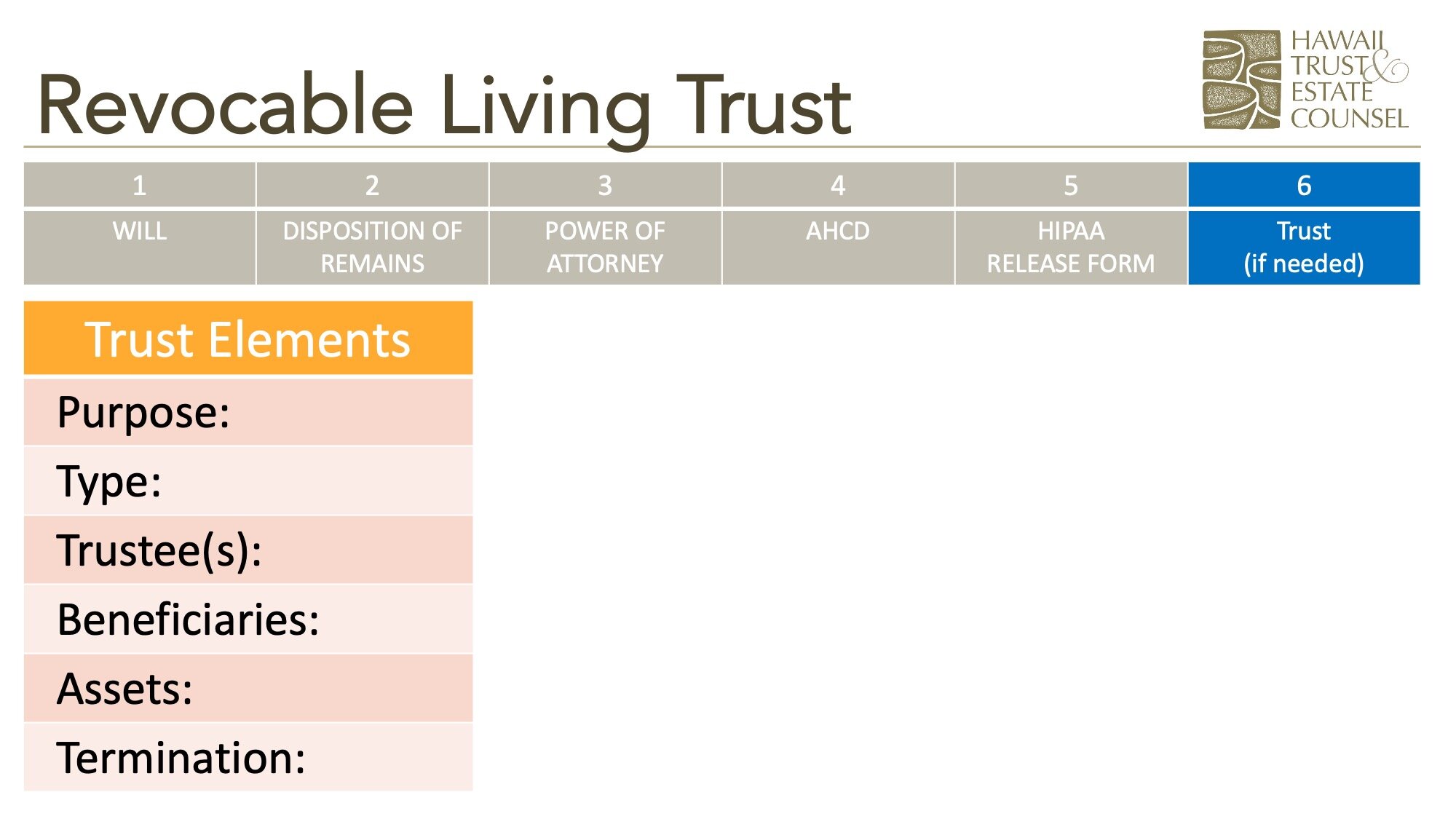

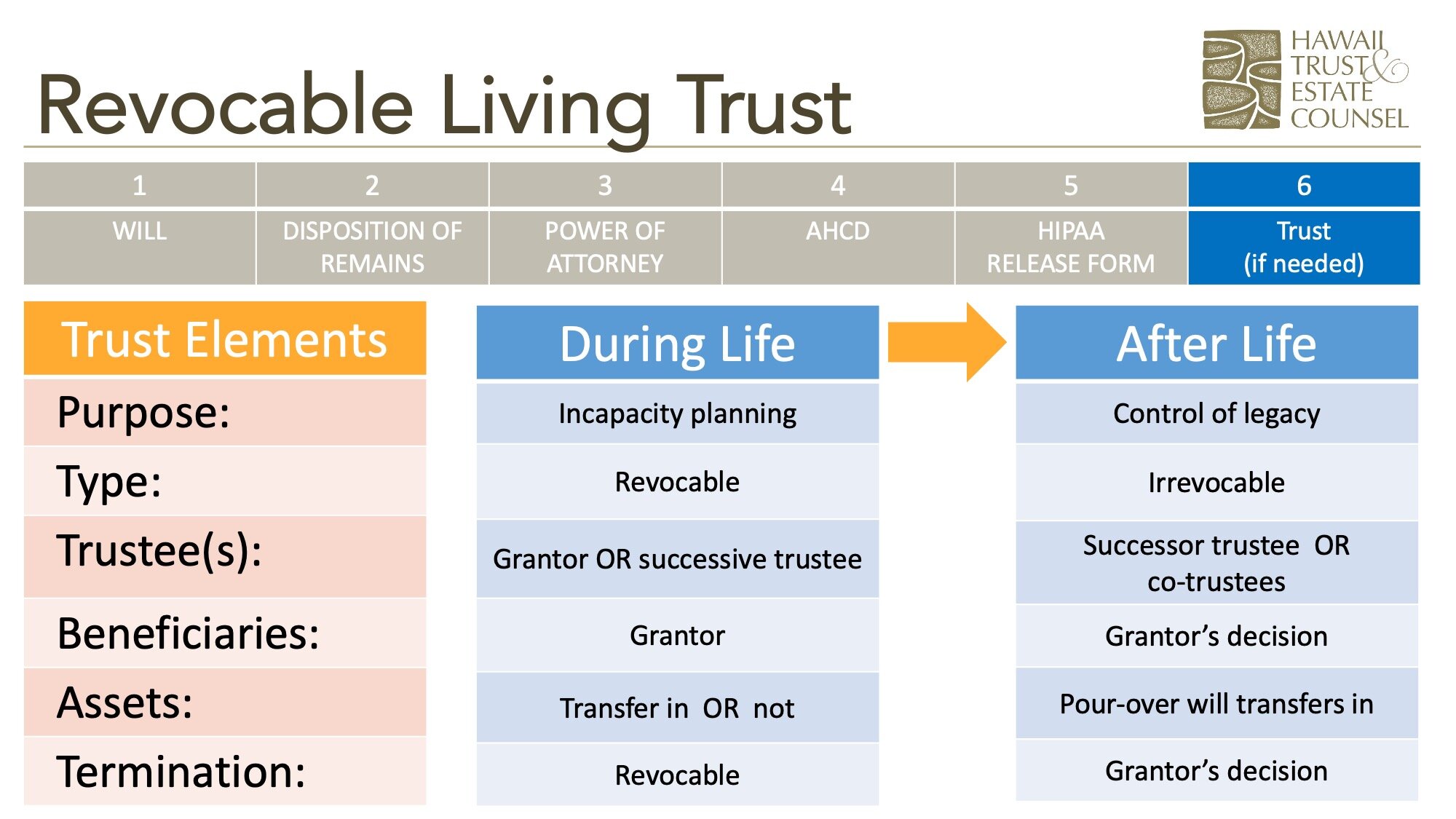

The basic estate planning documents generally consist of the following: a will, disposition of remains, revocable living trust (if needed), durable power of attorney, advance health care directive, and HIPAA Release Form.

1. WILL

A properly executed will determines the distribution of real and personal property at death and names a person to administer the estate. Jointly owned property will pass automatically to the surviving owner(s) and will not be affected by your will.

2. DISPOSITION OF REMAINS

After life, this burial instructions document designates how remains are handled (usually cremation vs. burial), who works with the mortuary or crematory, and may include other specific instructions.

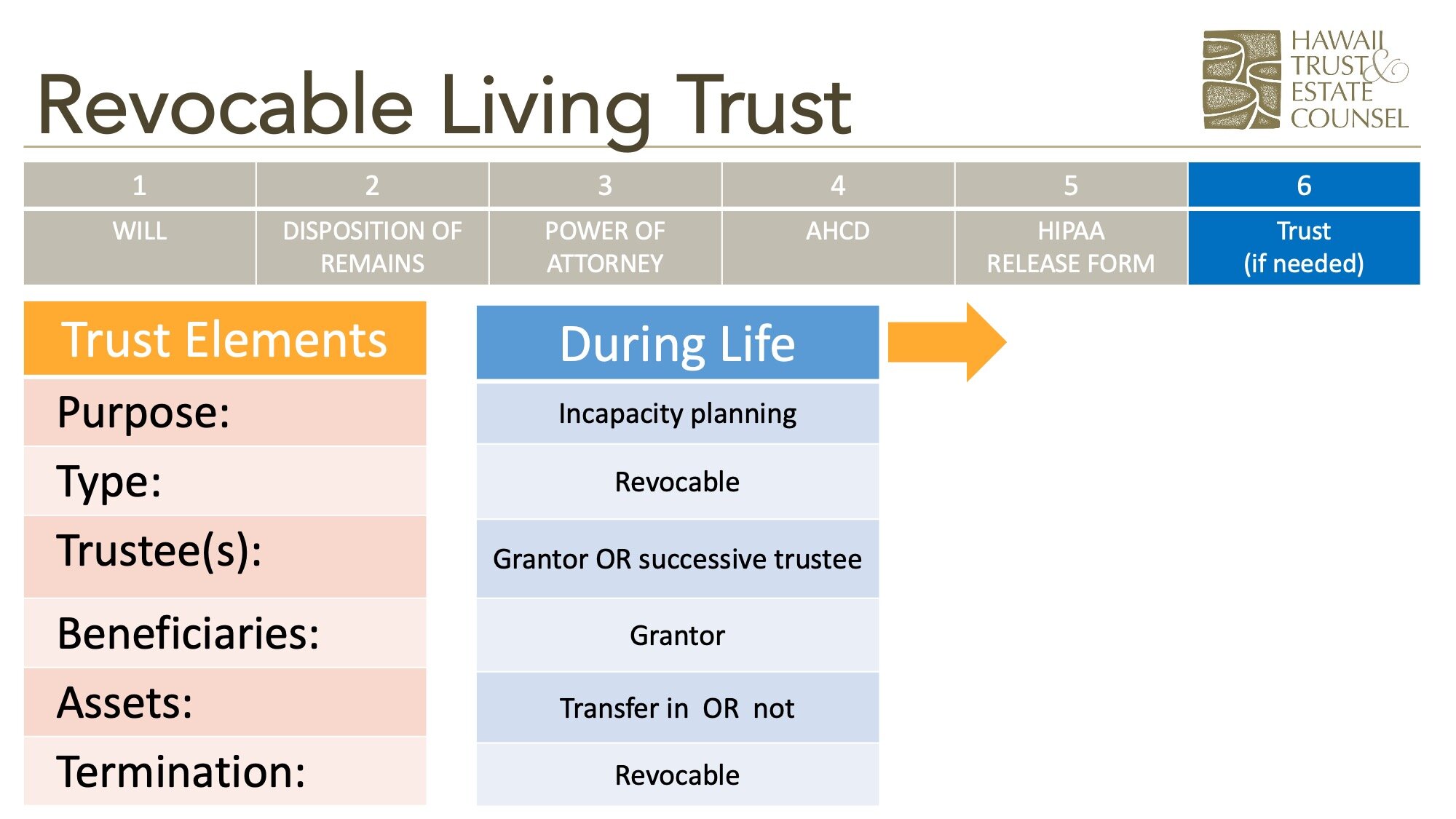

3. REVOCABLE LIVING TRUST

A trust can be used to avoid probate, which may save some settlement costs, especially if you own real property located outside of Hawai`i. A trust can be helpful in the event of your incapacity and can provide for management of assets for children or other beneficiaries after your death. At times, a trust may also be indicated for estate tax reasons.

4. DURABLE POWER OF ATTORNEY

A power of attorney appoints another individual to act as your agent on your behalf. This document can be especially important if you become incapacitated. The alternative, a court-appointed guardian, requires legal proceedings that can be slow, expensive, public, and onerous over time.

5. ADVANCE HEALTH CARE DIRECTIVE

An advance health care directive (referred to sometimes as a Living Will and Healthcare Power of Attorney) facilitates the making of health care decisions by your agent if you are unable to make them yourself. Not having an advance health care directive leaves such decisions to your doctor and may result in uncertainty and family disharmony.

6. HIPPA RELEASE FORM

The Health Insurance Portability and Accountability Act (HIPAA) protects privacy of personal medical information. This form authorizes the disclosure of personal health information to the persons/entities designated, which is useful in the event of incapacity.

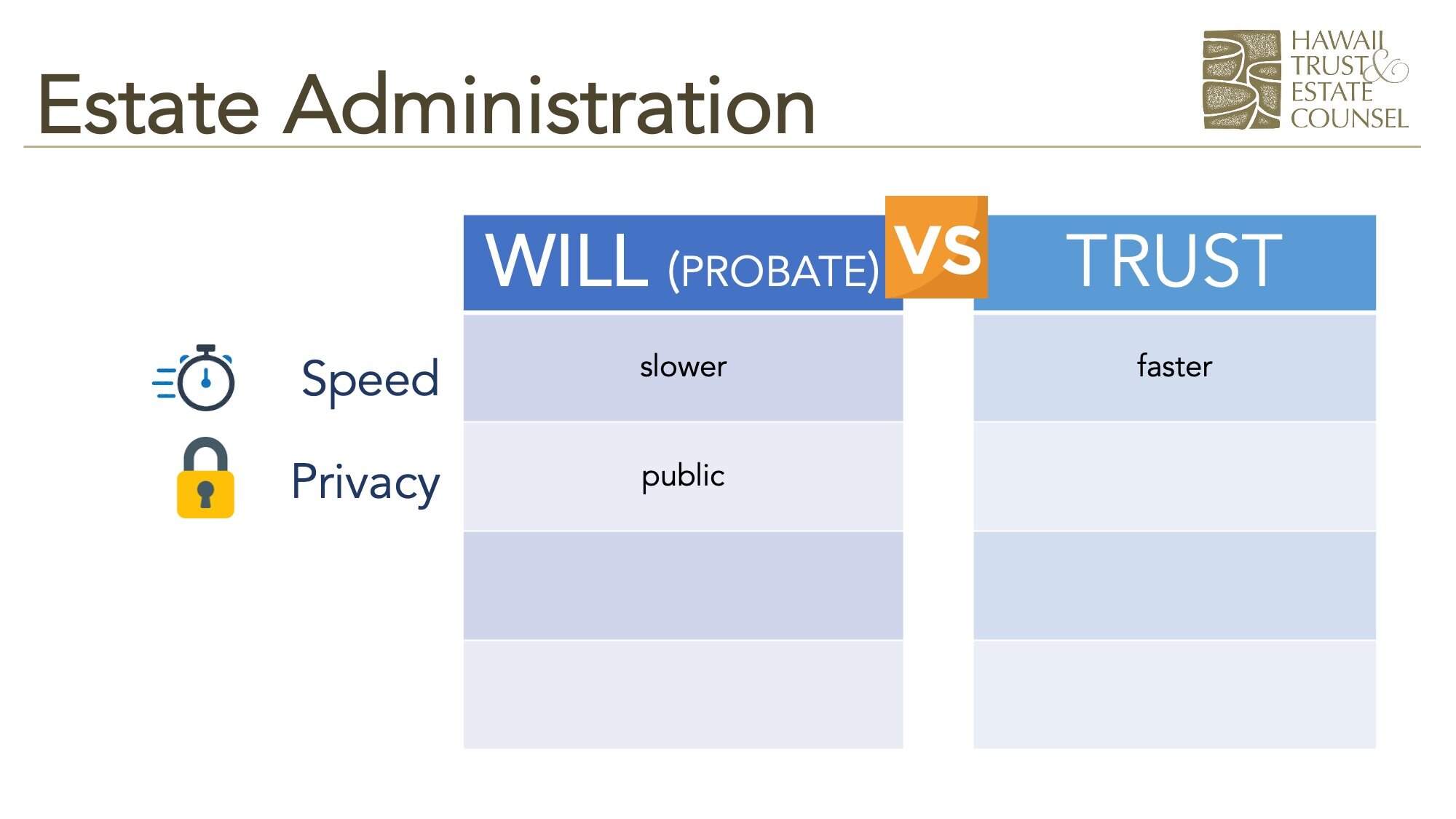

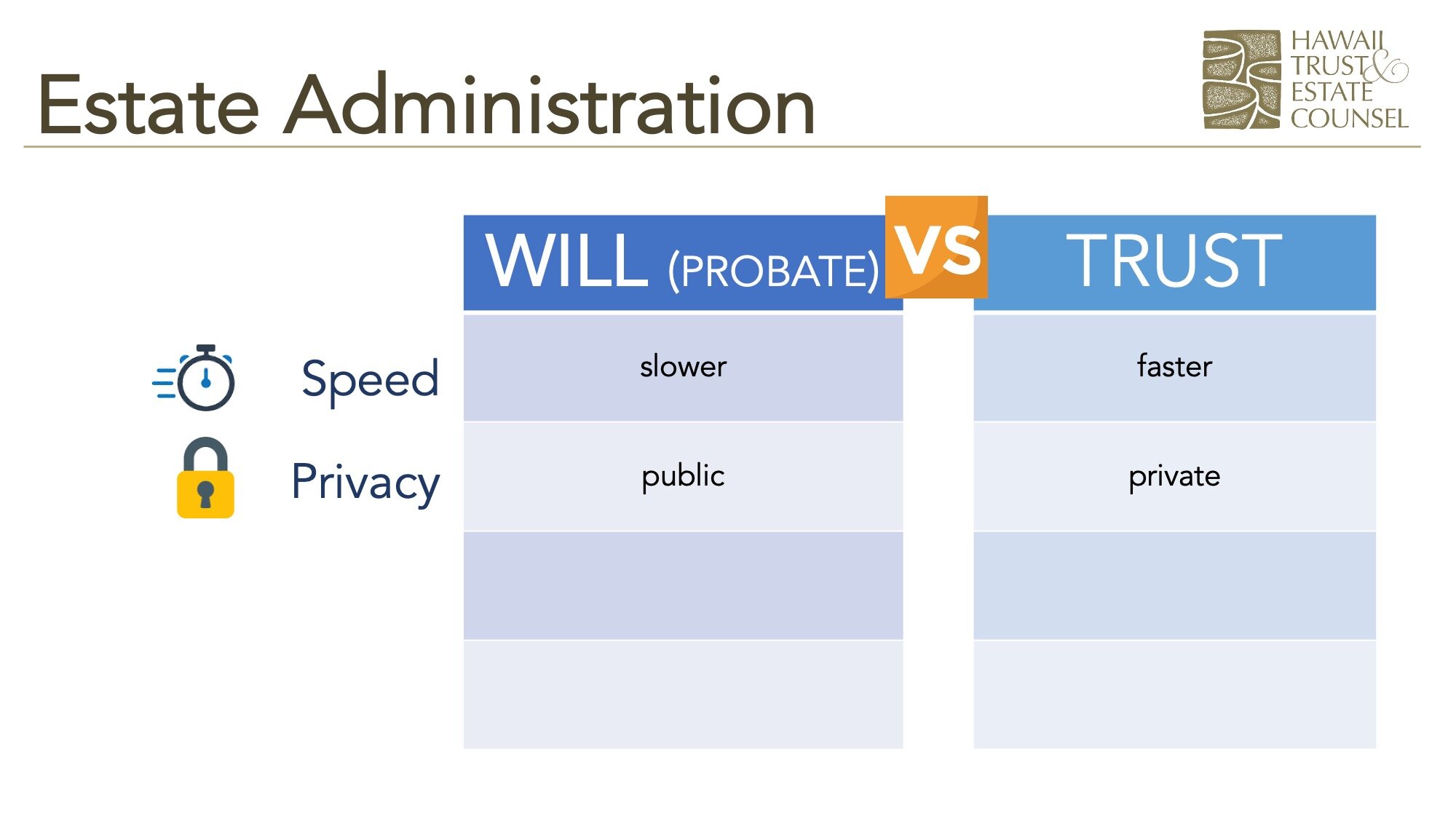

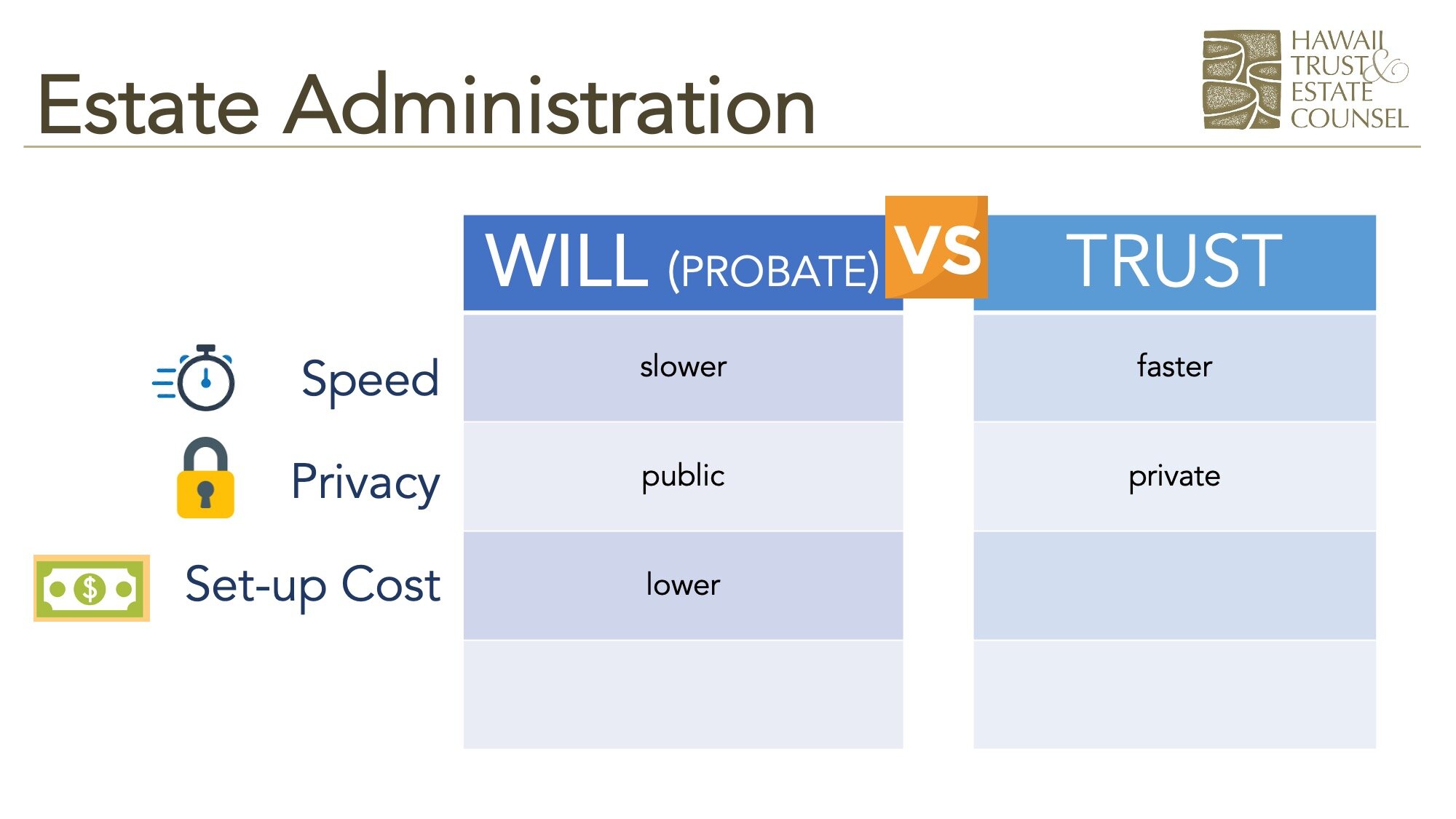

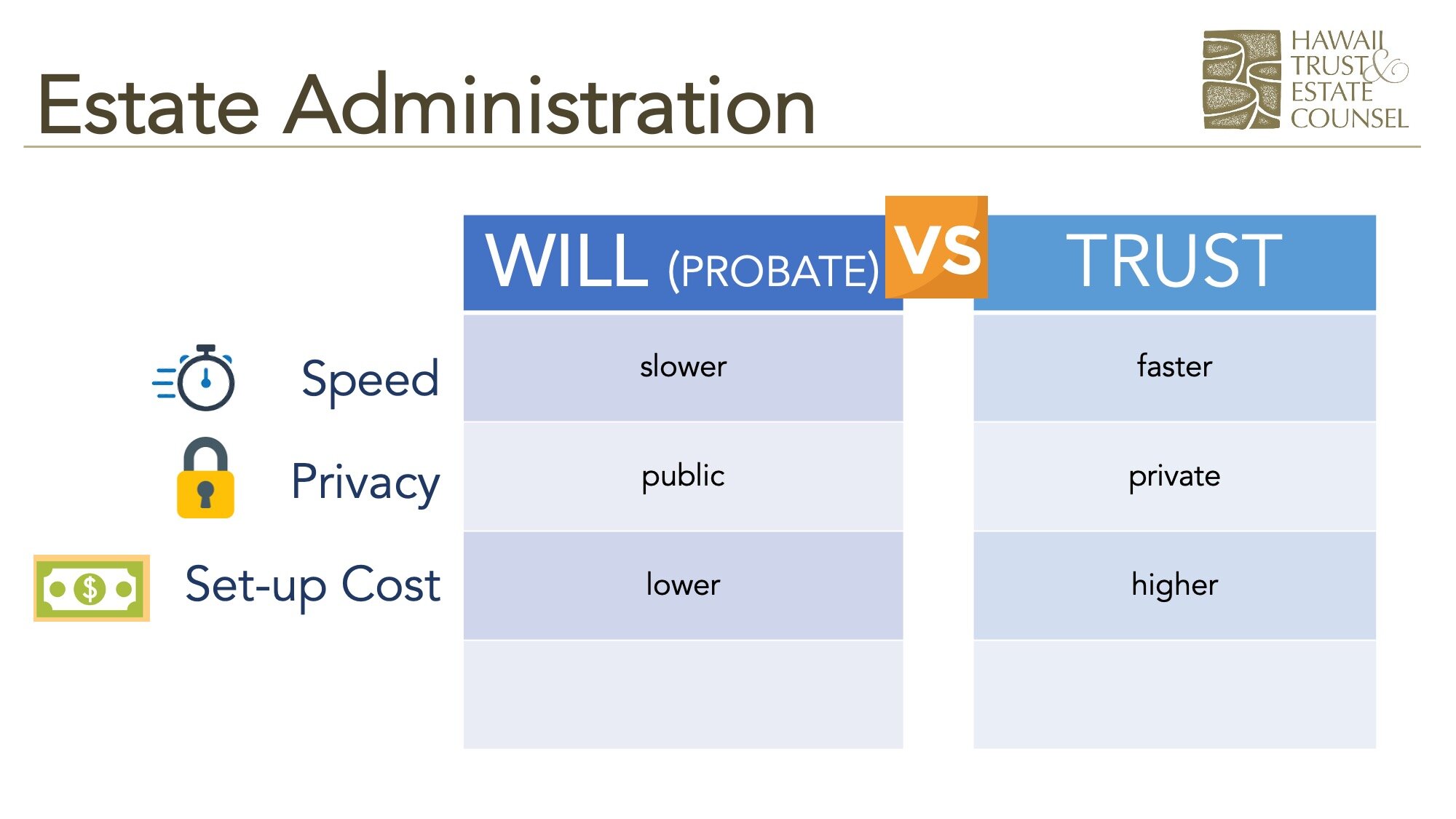

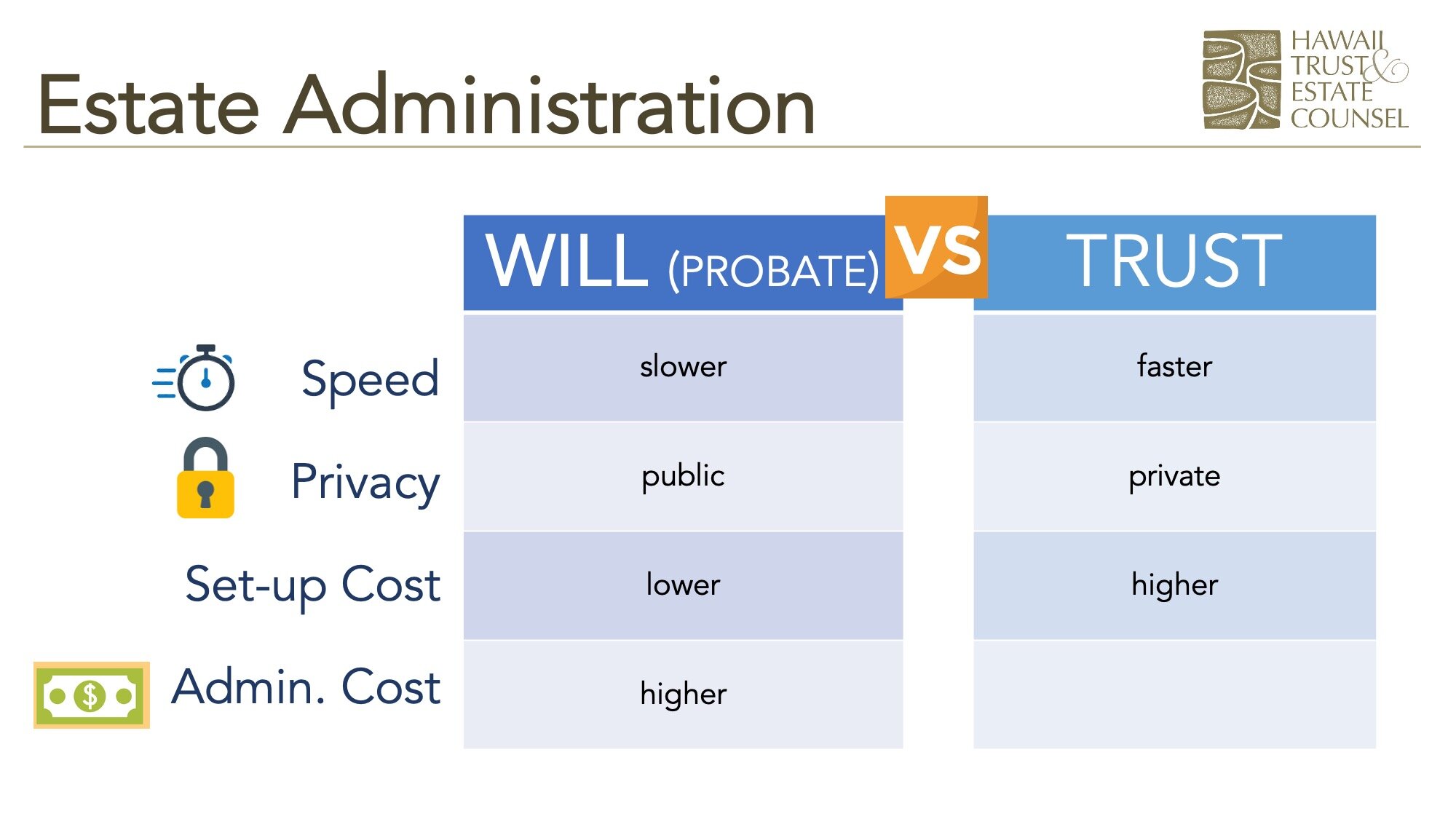

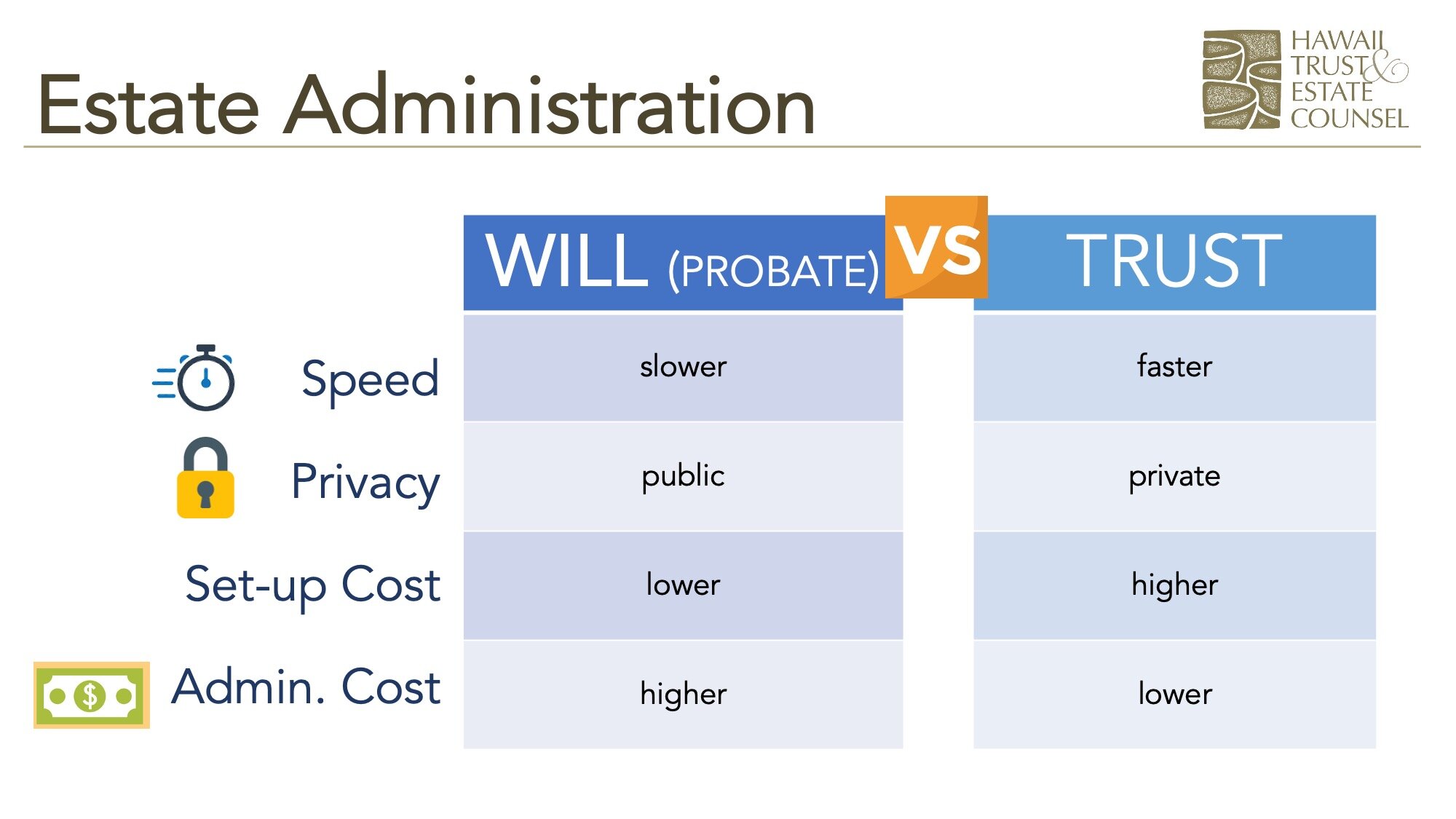

WHAT IS THE DIFFERENCE BETWEEN A WILL AND A TRUST?

It is possible to use either a “will” or a “trust” to direct property into the right hands following your death.

While wills accomplish little more than that limited goal, trusts can also be used to avoid the probate process and perhaps accomplish other goals such as protecting property in the event of a lawsuit, minimizing taxes, and reducing the chances of lawsuits. Such trusts must be funded with property while the person is still alive. That is why they are sometimes called living trusts.

The main reason many people use only a will is that living trusts can cost more to establish and perhaps add a degree of complexity. In terms of overall cost (both the cost to set up and administer after your lifetime) using only a will versus a trust and pour-over-will are comparable. The decision should be made based on a current snapshot of your life, including assets, priorities, people you care about and your goals.

WHAT ARE THE ELEMENTS OF A TRUST?

A trust may be used in addition to a will to determine when, how and to whom a decedent's assets will be distributed. If the trust is created during life by a Settlor or Grantor, and if all significant assets are transferred into it, a probate will not be required. The trust "survives" death and may continue well beyond it; the Successor Trustee will be in charge of its administration and the management of the assets until the trust terminates and those assets are distributed.

The responsibilities of a Trustee and Personal Representative are very similar. Each must protect assets, pay creditors, and hold and/or distribute the estate assets to the designated beneficiaries.

A Successor Trustee may generally assume his or her responsibilities without court appointment. As with any administration, however, additional institution-specific documentation may be required for some assets, such as bank or investment accounts.

While ongoing trust administration generally does not require court supervision - or any court involvement at all - Trustees are held to a fiduciary standard that can be enforced in court by the beneficiaries, if necessary.

TRUST SERVICES

We are available to review and explain the terms of a trust, to advise a trustee about his or her fiduciary duties and the responsibilities owed to the trust beneficiaries, and to explain the workings of an continuing trust to all involved. We can also assist with ongoing trust administration, distributions and termination. Generally we do not, however, handle trust litigation.

BENEFITS OF A TRUST

Having a trust can be used to avoid probate, which may save some settlement costs, especially if you own real property located outside of Hawaii or if you have assets totaling $100,000 or more. Trusts can also be helpful in the event of your incapacity and can provide for management of assets for children or other beneficiaries after your death. At times, a trust may also be indicated for estate tax reasons. Trusts can also be complex and a conversation about your goals and assets should be had with an estate planning attorney before making any big decisions.

QUESTIONS FROM PARTICIPANTS

Before and after the webinar we got a lot of great questions from participants who tuned in live. Here are some of the questions and answers that came up:

How long does the estate planning process take?

At our firm, it usually takes a few weeks from the initial meeting to having your final documents in-hand. It also varies based on many factors, including how complex the plan is and the availability of the attorney.

Initial Meeting

At the initial meeting you share your current situation and goals with the attorney in-person (currently with social distancing and safety measures in place), over the phone, or by video.

The attorney then explains your options and you make a plan based on what you decide.

You will also be provided with a quote at this first complimentary meeting.

Document Drafting

The documents discussed at the first meeting are prepared by an attorney according to your unique situation.

Further correspondence by phone or email my be needed to confirm details.

Document Signing

At the document signing, the attorney reviews the final documents with you and makes sure you understand your plan.

Then the documents are signed and executed. Some documents require notarization, witnesses, and sometimes recorded with the appropriate authorities.

Document Pickup

Once the fully executed documents are scanned and packaged in an organized file for you, they are ready for pickup or delivery by mail.

Electronic copies can also be provided.

We will also provide instruction on any other steps you should take with your new estate plan.

For more about the estate planning process and how to prepare for that first meeting please click here.

What’s the best way to avoid probate?

There’s no “best way” to avoid probate without knowing your specific situation. First of all, for those who may not know, probate is the process of obtaining court authority to manage a decedent's assets. The process involves the nominated personal representative obtaining County approval by filing certain documents and paperwork with authorities. Probate has the reputation of being long, arduous, and expensive, but that’s not always the case.

The two things that generally trigger probate:

Real Property: such as land, a home, or a timeshare (in each State)

$100,000 or more in assets

Setting up a trust is a common way to bypass probate, but it could also be done with only a will, as long as the rights of survivorship and designated beneficiaries of assets are set up correctly.

For more about probate, please see the Just Ask John post “What is Probate?”

Does the executor need to sign the will or trust document?

No, the executor or personal representative is not required to sign the will or trust document. We do recommend that you check with them before naming them in your will or trust to make sure they’re up for the responsibility.

Does the executor need to live in Hawaii?

No, the executor or personal representative does not need to live in Hawaii. In our experience, much of the estate administration can be done by email or phone, such as hiring a real estate agent. It does get tricky when dealing with tangible personal property, such as cars, jewelry , and art, from afar.

When does a trust become effective?

A trust becomes effective upon singing the trust document, which usually happens at the signing meeting with your attorney.

What is the price of a trust?

All pricing is based on the complexity of the overall plan for each individual client or couple and is quoted at the first meeting. We do not charge for the first meeting. We would usually not only draft a trust for a client, but include a trust in a comprehensive estate plan, which also includes a will (that pours-over into the trust), disposition of remains, durable power of attorney, advance health care directive, and HIPAA Release Form. Sometimes clients already have a trust and it just needs to be updated.

We hope you found this information on basic estate planning, in Hawaii, helpful. If you have any questions please comment below or contact us.

PRESENTER

JOHN ROTH

John is the founder of Hawaii Trust & Estate Counsel, a statewide Hawaii estate planning law firm with offices in Waimea, Hilo, Kona, Maui, and Honolulu. He has taught Estate Planning at the Richardson School of Law, and business law courses at the University of Hawaii—Hilo. He started “Just Ask John” as a monthly newspaper column answering commonly asked estate planning questions, in the North Hawaii News, then in The West Hawaii Today. Now it’s an online blog and video series. ....MORE

WEBINAR HOST: TUTU'S HOUSE

Mahalo to Tutu's House for hosting this webinar. We regularly present in-person at Tutu's House in Waimea, but due to COVID-19, this presentation was hosted virtually.

Located in Waimea, in North Hawai`i, Tutu’s House is a community creation. Based on the belief that our greatest resource is our people. Tutu's House hosts community members to volunteer to lead activities, build relationships as they learn together, and contribute financial support when they can. The activities and other resources Tutu’s House shares are available free of charge.

One of Friends of the Future’s earliest initiatives, the Health and Wellness Group, formed to change the course of the community’s health by developing a new model of health with the community leading the way. After conducting a community health needs assessment, Friends of the Future began to facilitate community members’ efforts to create a wellness resource center, which became Tutu's House.

MAKE AN INFORMED DECISION

Everyone has a different story and should have a unique estate plan. In most cases, the first meeting with one of our attorneys is complementary and serves the purpose of understanding your goals and educating you on your options. Depending on the option that is right for you, we will give you a price quote at the first meeting, before moving forward with your plan. Feel free to explore the basic information on our website and contact us to set up an initial phone meeting at no cost.

ESTATE PLANNING WITH SOCIAL DISTANCING

At Hawaii Trust & Estate Counsel, our goal has always been to help clients plan for the unknown with informed, proactive, plans. Today, as we face a time of uncertainty about COVID-19, we’d like to share what we’re doing to protect the health and safety of our clients, team, and community.

Under the Governor’s “stay at home” proclamation, legal services are listed as essential businesses. In some cases, the services we provide are essential to clients facing medical or other emergencies. We will remain available to safely serve clients.

Here are some of the measures we are taking to ensure the health and safety of our clients, team, and community:

We are encouraging the option of meeting over the phone, instead of having in-person meetings, when possible.

If clients need to come in to sign documents, we are requiring employees and clients to practice social distancing by maintaining a minimum of six-feet of physical separation. No more than one client or couple will be seen at one time. Our offices have been rearranged to designate six-feet of distance between clients and employees. We also offer the option of coming out to client’s cars for signings, if they would prefer not to enter the office. The signing pen will be given to the client who uses it.

In response to COVID-19, we’ve increased the frequency and extent of cleaning and sanitation at all offices. Everything that a client touches when in the office will be sanitized before the next client enters. We have made hand sanitizer and sanitizing products readily available for employees and clients.

This blog does not contain legal advice. You should not rely on this to determine what is in your own best interest. For legal advice, specific to your situation, you must meet with an attorney. All examples are based on hypothetical scenarios, not the actual circumstances of real clients.

What assets should you put in your trust? Avoiding probate, planning in case of incapacity, and making things as easier for loved ones after your death are all things to consider.