HOW DO I PREPARE FOR ESTATE PLANNING?

So, you made the decision to get your will or trust done, but how do you prepare for the first meeting with an estate planning attorney? It might be easier than you think. Watch the video above or read below for how to prepare for estate planning.

WHAT IF I JUST NEED AN UPDATE?

A good estate plan will address your current goals given your current situation. This means that as your situation changes regarding your family, assets and overall goals, your estate plan may need to be updated to reflect the changes. Also, estate planning is generally governed by State law, which means if you created your documents outside of Hawaii, you will want to review your documents with an attorney licensed in the State of Hawaii to make sure your plan adheres to and takes advantage of local law. The best plan in one State may not be the best plan in another State. Many documents, such as a power of attorney or an advance healthcare directive, are more likely to be accepted by a bank or healthcare institution if they are less than five years old.

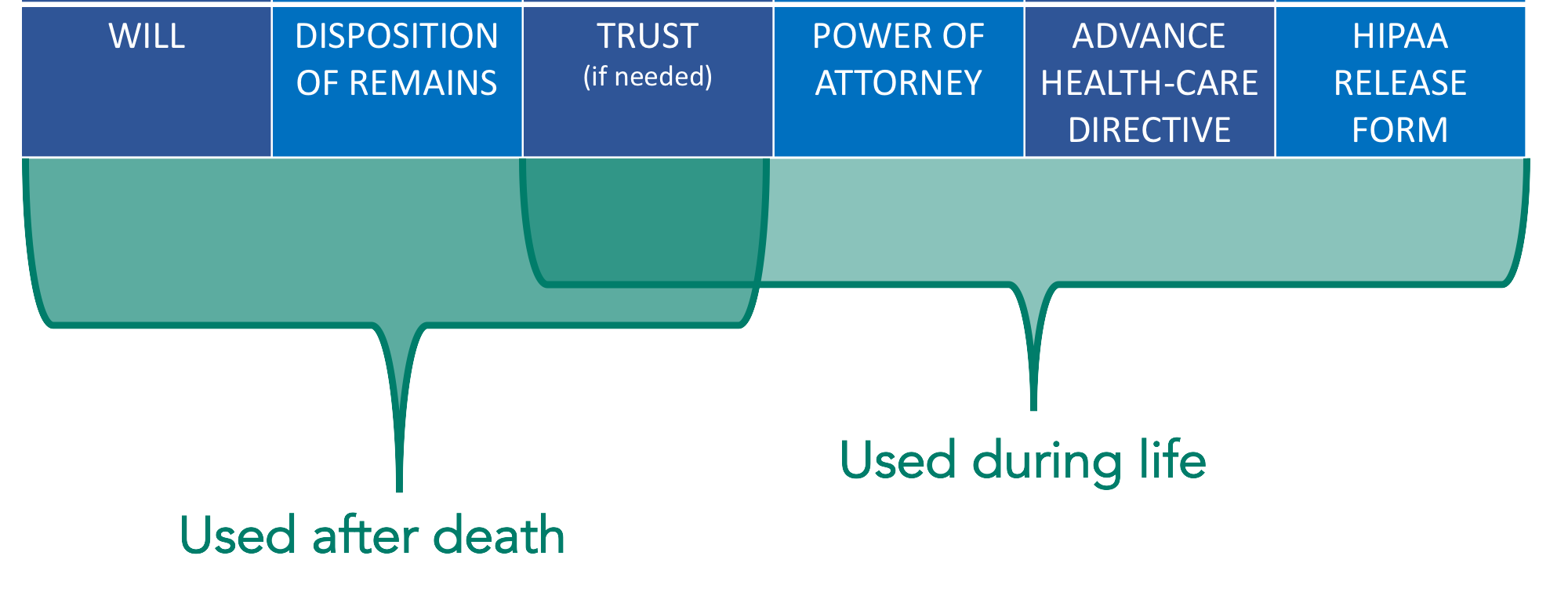

First, if you’ve had a will or trust made before, you should bring those documents to the estate planning meeting, as a starting point and to see what may need to be changed in the new documents. Your most recent set of estate planning documents generally supersedes or revokes any older documents. Below are the most commonly used estate planning documents.

ESTATE PLANNING DOCUMENTS:

Here’s a complementary worksheet to help prepare for your first meeting if you are reviewing your estate plan.

WHAT IF I’VE NEVER DONE ESTATE PLANNING?

Thinking about incapacity and death are not easy topics for anyone. But thinking about what you’d like to happen, if you’re not able to make decisions yourself, can save your loved ones time, money, and potential disharmony in the future. Committing to doing your estate plan can be difficult in its self, so we try to make preparing for the first meeting easy. You really need to know just three things and don’t need to bring any documents.

WHAT DO YOU OWN?

First, you should have a clear idea of what assets you own. This includes real property, bank accounts, retirement and investment accounts, and life insurance. Also, you should know how these assets are titled. Are they listed just in your name or are they owned jointly with someone else? For real property, this information should be on your deed. On certain accounts, you may have a designated beneficiary listed to inherit this asset. Being aware of who is listed as a designated beneficiary on account is important because designated beneficiary provisions supersede beneficiaries listed in a will or trust. Things like art, cars, and jewelry are considered tangible personal property and can be listed separately in a Memorandum Regarding Tangible Personal Property.

HOW MUCH IS IT WORTH?

Second, you should come to your first estate planning meeting having a general idea of what your primary assets are worth. This does not have to be an exact dollar amount of what’s in your bank account or what your house was appraised at, just a general idea of how much they are worth.

WHAT ARE YOUR GOALS?

Lastly, you should start thinking about what your goals are with estate planning. What do you want to make sure happens in the event of your incapacity or death. Do you want to make sure your minor children or your spouse is taken care of? Do you want to leave anything to charity?

One of the first questions to ask yourself is: Who do you want your property to go to at death? If you do not let your wishes be known, state statutes will determine your beneficiaries. A will or will substitute, such as a revocable trust, lets you control the distribution of your property.

Next, ask yourself: Who should carry out your wishes? At your death, important details will have to be handled by your Personal Representative if you use a will, or by the Successor Trustee if you use a trust. The job can be challenging and the consequences of not doing it correctly can be harsh, including the possibility of litigation between family members. Do you want to use a bank or trust company because of its expertise? A relative or friend because of their knowledge of the property or individuals involved? Someone else? Perhaps a combination of these options? By engaging in estate planning now, you can choose the approach that makes the most sense in your circumstances.

Here’s a complementary worksheet to help prepare for your first meeting if you are new to estate planning.

SHOULD YOU CONSIDER USING A TRUST?

Additionally, are there reasons why you should consider using a trust? A simple will is sufficient for some people. Others benefit from using a trust as a will substitute, or by including trust provision in their will. For example, a trust can be particularly helpful in the following circumstances:

If you want to control who will benefit from your property after the initial beneficiary has died. This is particularly common when a person’s spouse is not the parent of the person’s children.

If you are concerned that a child or grandchild may someday get divorced from a spouse, or you do not want any of your estate to be subject to the claims of any beneficiary’s past, present, or future creditors.

If you are concerned that a child or grandchild might not yet be ready to manage his or her inheritance.

If a beneficiary may eventually be wealthy and you want to minimize estate taxes at that person’s death.

WHAT ABOUT INCAPACITY PLANNING?

Who would you like to make important decisions for you in the event of incapacity? People sometimes become legally incapacitated prior to death. In preparation for such a possibility, many people choose to give a durable power of attorney to a trusted family member. Others use a trust for this purpose. The former approach is relatively simple and inexpensive; the latter is less prone to abuse. In any event, an Advance Health-Care Directive lets you make important healthcare decisions ahead of time. You can also authorize someone else to make such decisions. Most people prefer a carefully thought-out combination of these two approaches.

The best estate plan is what an informed person decides. Everyone has a different story. Until you sit down with an attorney, it's difficult to know what your options are. In most estate planning cases, the first meeting is complementary and we will give you a quote for the option you choose, before moving forward with your plan.

JOHN ROTH

John is the founder of Hawaii Trust & Estate Counsel, a statewide Hawaii estate planning law firm with offices in Waimea, Hilo, Kona, Maui, and Honolulu. He has taught Estate Planning at the Richardson School of Law, and business law courses at the University of Hawaii—Hilo. He has resided in North Hawaii since 2008....MORE

MAKE AN INFORMED DECISION

Estate Planning is necessary because, as the old expression goes, "You can't take it with you" and you never know what's going to happen in life. The estate planning documents of an advance health-care directive, power of attorney, and sometimes a trust help someone step into your shoes to make decisions on your behalf, during your lifetime. Then after your lifetime, you may need a will or will substitute, such as a revocable living trust, if they want to control who inherits their property and how and when that inheritance is received, to minimize administration costs, and to avoid unnecessary taxes. A well-planned estate is a gift to your loved ones and provides you peace of mind. It is part of your legacy.

Everyone has a different story and should have a unique estate plan. In most cases, the first meeting with one of our attorneys is complementary and serves the purpose of understanding your goals and educating you on your options. Depending on the option that is right for you, we will give you a price quote at the first meeting, before moving forward with your plan. Feel free to explore the basic information on our website.

This blog does not contain legal advice. You should not rely on this to determine what is in your own best interest. For legal advice, specific to your situation, you must meet with an attorney. All posts are based on hypothetical scenarios, not the actual circumstances of real clients.

What assets should you put in your trust? Avoiding probate, planning in case of incapacity, and making things as easier for loved ones after your death are all things to consider.