WHAT IS A MEMORANDUM REGARDING TANGIBLE PERSONAL PROPERTY?

Do you have things that you would want to go to certain people after you die? Maybe you'd want your daughter to have your car or your best friend to have a certain piece of art? That's where the Memorandum Regarding Tangible Personal Property comes in.

This simple document lists your tangible assets and who you'd like them to go to. Tangible assets are generally things you can touch. Examples of tangible assets are jewelry, cars, art, pets, toys, musical instruments, etc. Things that are not tangible assets and cannot be listed on this document are bank accounts, cash, investment accounts, real estate, and life insurance.

WHAT IF I HAVE A WILL BUT NO MEMORANDUM OF TANGIBLE PERSONAL PROPERTY?

A Memorandum Regarding Tangible Personal Property is only necessary if you have certain tangible assets that you would like certain people to receive. If you want your surviving spouse or children to get everything and divide things up themselves, pursuant to your will, then you don't need a Memorandum Regarding Tangible Personal Property. Designating who gets what can sometimes help reduce disharmony within a family, after a loved one passes.

ONE PART OF AN ESTATE PLAN

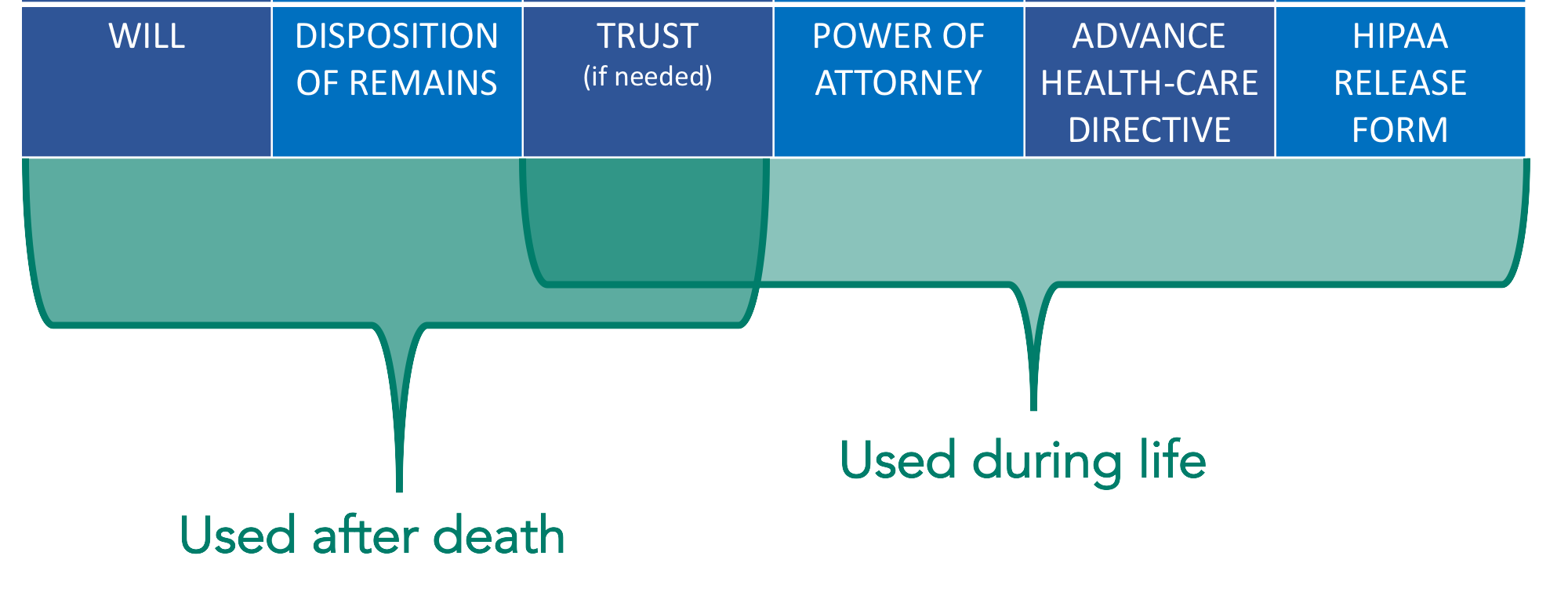

A Memorandum Regarding Tangible Personal Property is just one document that makes up a comprehensive estate plan. The basic estate planning documents generally consist of the following: a will, disposition of remains, revocable living trust (if needed), durable power of attorney, advance health care directive, and HIPAA Release Form.

BASIC ESTATE PLANNING DOCUMENTS

JOHN ROTH

John is the founder of Hawaii Trust & Estate Counsel, a statewide Hawaii estate planning law firm with offices in Waimea, Hilo, Kona, and Honolulu. He has taught Estate Planning at the Richardson School of Law, and business law courses at the University of Hawaii—Hilo. He has resided in North Hawaii since 2008....MORE

MAKE AN INFORMED DECISION

Estate Planning is necessary because, as the old expression goes, "You can't take it with you" and you never know what's going to happen in life. The estate planning documents of an advance health-care directive, power of attorney, and sometimes a trust help someone step into your shoes to make decisions on your behalf, during your lifetime. Then after your lifetime, you may need a will or will substitute, such as a revocable living trust, if they want to control who inherits their property and how and when that inheritance is received, to minimize administration costs, and to avoid unnecessary taxes. A well-planned estate is a gift to your loved ones and provides you peace of mind. It is part of your legacy.

Everyone has a different story and should have a unique estate plan. In most cases, the first meeting with one of our attorneys is complementary and serves the purpose of understanding your goals and educating you on your options. Depending on the option that is right for you, we will give you a price quote at the first meeting, before moving forward with your plan. Feel free to explore the basic information on our website.

This blog does not contain legal advice. You should not rely on this to determine what is in your own best interest. For legal advice, specific to your situation, you must meet with an attorney. All posts are based on hypothetical scenarios, not the actual circumstances of real clients.

What assets should you put in your trust? Avoiding probate, planning in case of incapacity, and making things as easier for loved ones after your death are all things to consider.