SHOULD YOU HOLD YOUR INVESTMENTS IN TRUST?

So you’ve set up a trust, but you’re not sure if your investment account should go into the trust. Each person’s reasons for setting up a trust and goals in investing are different, so the best way to know what you should do is to make an appointment with an estate planning attorney in the state you live in. Generally speaking, trusts are set up to make sure assets are used in the way their owner intends and to possibly avoid probate, so it makes sense to put your investments in trust. We’ll explain why below.

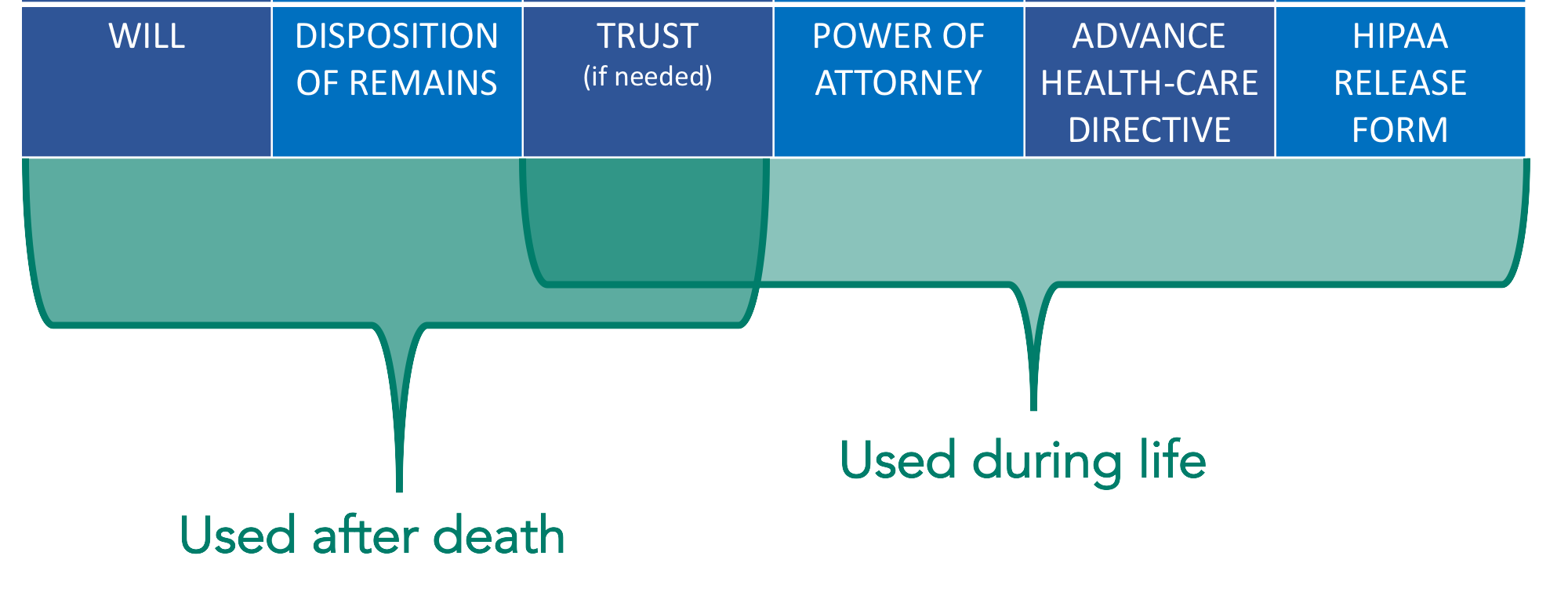

BASIC ESTATE PLANNING DOCUMENTS

IN TRUST vs. OUT OF TRUST

A trust is one of the estate planning tools to make sure your wishes are carried out in the event of your incapacity or death. It may be easiest to think of a trust as an entity, like an LLC, where assets can be transferred into and taken out of the trust throughout your lifetime. The way you work with an investment account “in trust” does not differ from how you would work with it if it were “out of trust” or listed in your individual name. The trust also carries on after your lifetime, is managed by rules, and has ultimate beneficiaries that you decide upon when creating the trust. When a person is living and has capacity, they are usually the sole trustee and beneficiary.

BENEFITS OF A TRUST

Having a trust can be used to avoid probate, which may save some settlement costs, especially if you own real property located outside of Hawaii or if you have assets totaling $100,000 or more. Trusts can also be helpful in the event of your incapacity and can provide for management of assets for children or other beneficiaries after your death. At times, a trust may also be indicated for estate tax reasons. Trusts can also be complex and a conversation about your goals and assets should be had with an estate planning attorney before making any big decisions.

WHAT IS INCAPACITY PLANNING?

Most people think of planning for death when doing their estate planning, but estate planning also plans for potential incapacity while you are still living. There is spectrum of capacity, from having the full mental capacity to handle your own affairs and make good judgements, to the point of incapacity, where you don't have a firm grip on what's going on and may need someone to help handle your affairs, like paying bills and making medical appointments. Capacity may decline over your lifetime, with the advent of dementia or Alzheimer's disease, or you may temporarily become incapacitated, such as if you are in an accident, where someone may have to help you make decisions and do things, such as pay bills. Legally speaking, there is also testamentary capacity, also called "sound mind", which is the legal capacity to sign documents.

WHAT IF I DON’T HAVE A TRUST?

If you don’t have a trust, you aren’t going to put your investments in trust. Setting up a trust is not necessary for everyone. Designated beneficiaries should be filled out with your financial advisor to designate who gets the investment account in the event of your death. Both a primary beneficiary and alternate should be listed in case something happens to the first beneficiary.

To learn more about trusts, please see:

We hope you found this information on how to hold property in Hawaii helpful. If you have any questions please comment below or contact us.

BIOS

JOHN ROTH

John is the founder of Hawaii Trust & Estate Counsel, a statewide Hawaii estate planning law firm with offices in Waimea, Hilo, Kona, Maui, and Honolulu. He has taught Estate Planning at the Richardson School of Law, and business law courses at the University of Hawaii—Hilo. He started “Just Ask John” as a monthly newspaper column answering commonly asked estate planning questions, in the North Hawaii News, then in The West Hawaii Today. Now it’s an online blog and video series. ....MORE

TAYLOR EASLEY

A 20-year veteran of the financial services industry, Taylor served as a financial advisor with both Smith Barney and Morgan Stanley before starting Easley & Associates. He received a bachelor’s degree, with honors, in banking and finance and managerial finance from the University of Mississippi. In addition, Taylor is a CERTIFIED FINANCIAL PLANNER™ professional, a certification awarded by the College of Financial Planning.....MORE

MAKE AN INFORMED DECISION

Estate Planning is necessary because, as the old expression goes, "You can't take it with you" and you never know what's going to happen in life. The estate planning documents of an advance health-care directive, power of attorney, and sometimes a trust help someone step into your shoes to make decisions on your behalf, during your lifetime. Then after your lifetime, you may need a will or will substitute, such as a revocable living trust, if they want to control who inherits their property and how and when that inheritance is received, to minimize administration costs, and to avoid unnecessary taxes. A well-planned estate is a gift to your loved ones and provides you peace of mind. It is part of your legacy.

Everyone has a different story and should have a unique estate plan. In most cases, the first meeting with one of our attorneys is complementary and serves the purpose of understanding your goals and educating you on your options. Depending on the option that is right for you, we will give you a price quote at the first meeting, before moving forward with your plan. Feel free to explore the basic information on our website.

This blog does not contain legal advice. You should not rely on this to determine what is in your own best interest. For legal advice, specific to your situation, you must meet with an attorney. All posts are based on hypothetical scenarios, not the actual circumstances of real clients.

What assets should you put in your trust? Avoiding probate, planning in case of incapacity, and making things as easier for loved ones after your death are all things to consider.