WHAT IS A SIGNATORY?

Estate planning is not just about planning for what happens to your stuff after your lifetime. It’s also used to plan for what happens during your lifetime, if you can no longer take care of yourself. Adding someone as a signatory on your bank account is a simple tool for incapacity planning, but it’s not right for every situation.

Incapacity can happen in a variety of different ways. Often, as people age, their cognitive capacity declines to the point that they can no longer manage their own financial affairs without help. Other times, incapacity happens suddenly, when someone is in an accident or has a sudden change in health, where they are unable to pay their bills or manage their accounts. When someone is incapacitated they may need a family member or other agent to step-in and help manage their affairs.

Adding someone as a signatory on your bank account allows someone to step into your shoes to help manage your financial affairs in the event of incapacity. To add someone as a signatory you just need to go with them to your bank and fill out the paperwork to add a signatory with them. You do not need to update any of your estate planning documents to use a signatory. After adding someone as a signatory, they have complete access to your account and can manage funds, write checks, and withdraw money on your behalf. This is useful if someone needs to pay bills on your behalf, but it can also be dangerous because the signatory has complete access to your funds.

HOW IS A SIGNATORY DIFFERENT FROM A JOINT OWNER ON A BANK ACCOUNT?

A signatory is not the same as a joint owner of a bank account. A signatory is only designated to sign on the owner's behalf and has no ownership rights. After the owner of the bank account passes away, the signatory does not own the bank account, as a joint owner would. The bank account goes to whoever is listed by the owner in their designated beneficiary provisions or according to the estate plan. With joint ownership, if one owner has creditors, the creditors can go after the jointly-held asset. If someone is a signatory, that person's creditors cannot go after the account they are signatory of.

WHAT ARE OTHER OPTIONS?

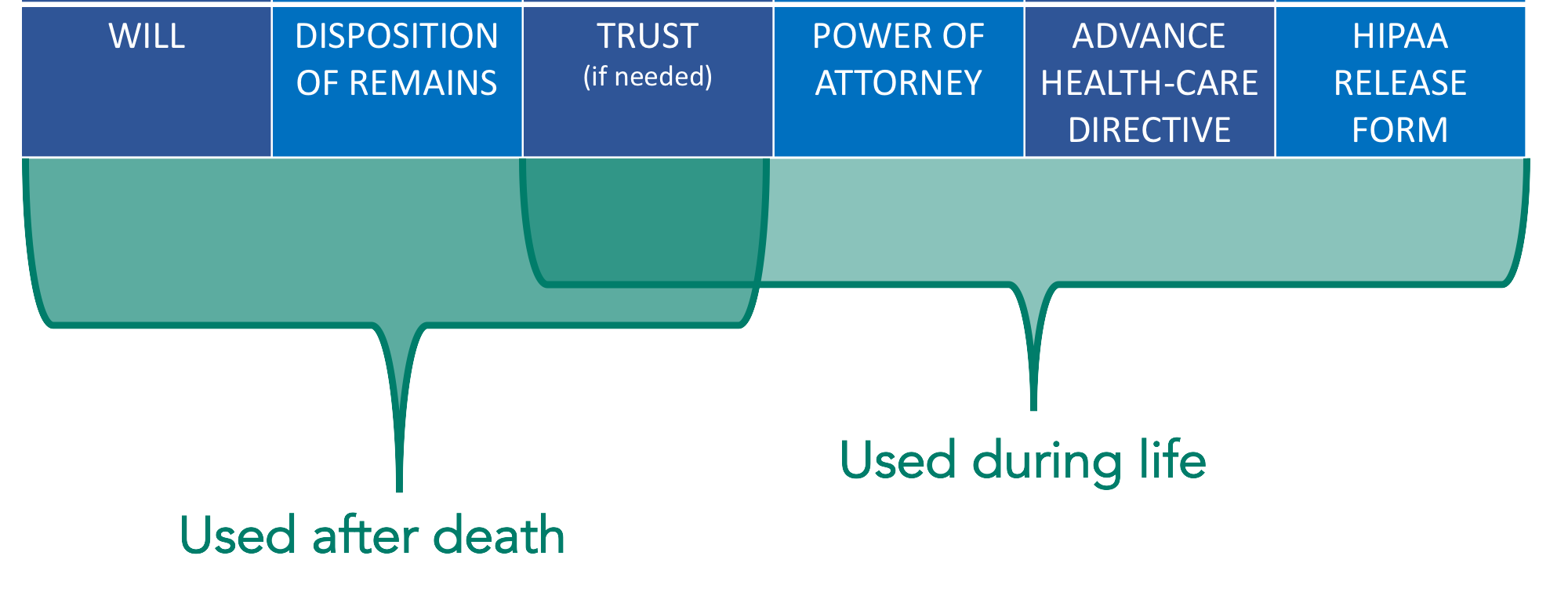

Adding someone as a signatory on a bank account is just one of the many tools of incapacity planning. The estate planning documents of a Power of Attorney or a Trust also may be used to give an agent access to manage your financial affairs, in the event of incapacity. Every person's family situation, goals, and assets are different and what may work for one person may not work for others. To determine what is in your own best interest, specific to your situation, meet with an attorney in your State.

JOHN ROTH

John is the founder of Hawaii Trust & Estate Counsel, a statewide Hawaii estate planning law firm with offices in Waimea, Hilo, Kona, Maui, and Honolulu. He has taught Estate Planning at the Richardson School of Law, and business law courses at the University of Hawaii—Hilo. He has resided in North Hawaii since 2008....MORE

MAKE AN INFORMED DECISION

Estate Planning is necessary because, as the old expression goes, "You can't take it with you" and you never know what's going to happen in life. The estate planning documents of an advance health-care directive, power of attorney, and sometimes a trust help someone step into your shoes to make decisions on your behalf, during your lifetime. Then after your lifetime, you may need a will or will substitute, such as a revocable living trust, if they want to control who inherits their property and how and when that inheritance is received, to minimize administration costs, and to avoid unnecessary taxes. A well-planned estate is a gift to your loved ones and provides you peace of mind. It is part of your legacy.

Everyone has a different story and should have a unique estate plan. In most cases, the first meeting with one of our attorneys is complementary and serves the purpose of understanding your goals and educating you on your options. Depending on the option that is right for you, we will give you a price quote at the first meeting, before moving forward with your plan. Feel free to explore the basic information on our website.

This blog does not contain legal advice. You should not rely on this to determine what is in your own best interest. For legal advice, specific to your situation, you must meet with an attorney. All posts are based on hypothetical scenarios, not the actual circumstances of real clients.

What assets should you put in your trust? Avoiding probate, planning in case of incapacity, and making things as easier for loved ones after your death are all things to consider.